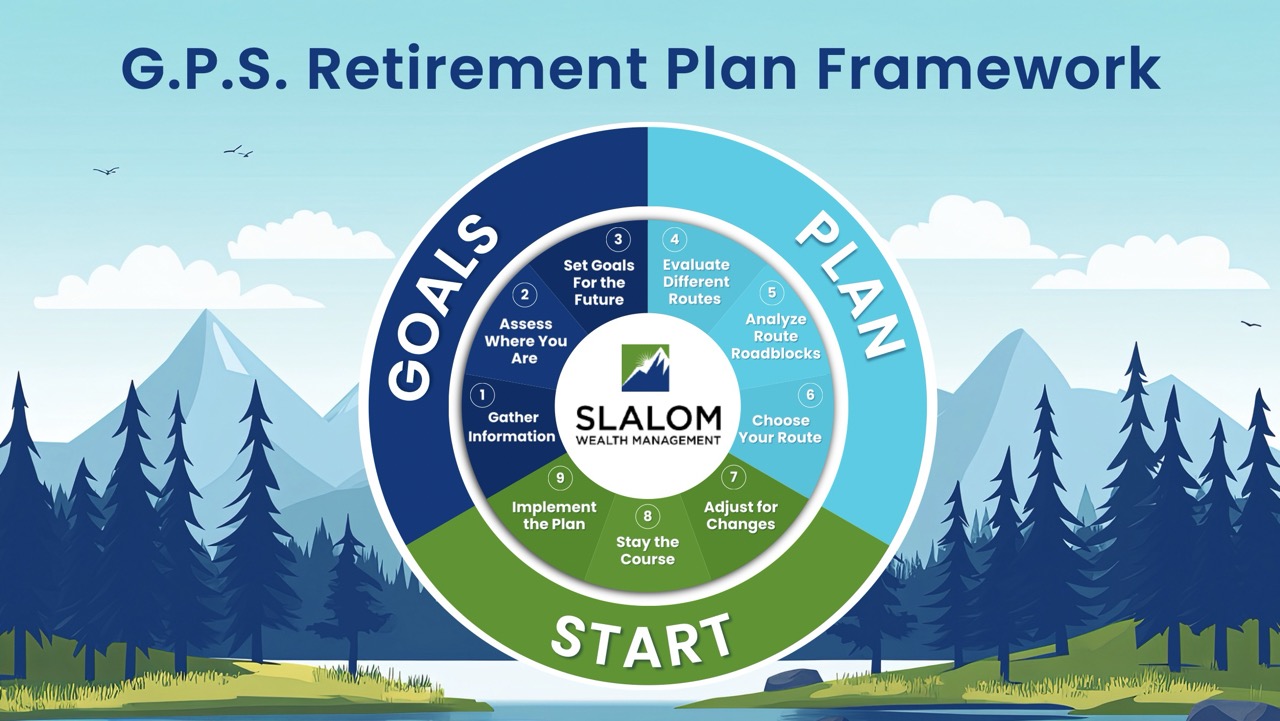

Let’s Talk About What’s Possible in Retirement

Learn more about our collaborative process

Who we work best with

We aren’t the perfect match for everyone. We work best with:

Savers

We work with diligent savers who have accumulated at least $500k in retirement savings.

Over 50

People nearing retirement or already retired

Collaborator

Planning-driven people looking for a collaborative partner

Our Free Assessment Process

Overcome your concerns and assess your options with our

collaborative approach.

Step 1

Schedule a 20-minute Call

Before we dive into any financial details, we want to start with a 20-minute phone call. This gives us both a chance to make sure your situation and objectives match our expertise.

Step 2

A 60-minute Discovery Meeting

Once we have determined that our experience aligns with what you need, we’ll schedule a one-hour discovery meeting via Zoom or in our office. This meeting focuses on conducting a deep dive into your personal situation so we can get crystal clear on your retirement goals, needs, and concerns.

Step 3

Review Our Assessment

Once your assessment is complete, we'll host another 60-minute meeting to review our findings and provide you with actionable recommendations. This includes exactly the steps you can take to help lower your taxes and implement an efficient investment strategy.

Step 4

Think On It!

There is zero pressure to buy anything or say "yes" We are not looking for transactional relationships, we are looking for long-term partnerships and recognize this is an important decision. After we present our findings, whether or not you decide to work with us, we want you to feel great about your decision. If you determine we aren't the right fit, we will do our best to recommend another professional who may be a better match. No strings attached!

Schedule your free assessment

Explore your financial opportunities with our 20-minute, obligation-free conversation

Frequently asked questions

Our fees are very straightforward and start at 1.00% per year on investments we manage with an annual minimum of $5,000

Our wealth management plans are founded on ongoing financial planning and investment management. Within this, we offer retirement planning, tax optimization, estate planning, and legacy planning for our clients.

We offer wealth management in Sacramento, California. We conduct most of our meetings remotely, which means we can work with clients located anywhere in the United States.

As a fiduciary, we are not tied to any other companies or products. Because of this, we will always act in your best interests – no exceptions.